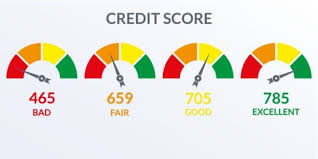

We live in a country where a good credit history is one of the most important things we can have. Without it you impair or lose your ability to borrow money. Most lenders require a minimum credit score to qualify for a mortgage and landlords are now ordering credit reports prior to renting you a home. Having no credit is worse than having bad credit. Undesirable credit can in most cases be explained but having no credit results in just that – no credit history.

Your credit history is comprised of credit cards, car loans, student loans, lines of credit and most recently your mortgage. One of the most important factors to maintain a healthy credit score is to show good repayment habits. At the very least make your minimum payment on or before your due date to do so. Failure to do this will show poor repayment habits and will affect your score and ability to apply for credit. A missed or late payment once or twice made up immediately can be explained as long as the rest of your credit has been paid as agreed.

Exceeding your credit limit will affect your score in a negative way so be very careful with this. If you are running close to your limit and your interest charge is added you may be pushed over your limit. Always take this it into consideration when you are making a payment. If your balance is close to your limit an option is to call the provider and ask for an increase in your limit which brings us to another factor in computing your credit score. Your available limit.

Credit utilization – how much you owe compared to your available limit affects your score so be aware. It is better to have 2 credit cards with your balance at 50% of the available limit than 1 card maxed out. If you have a card you are not using consider leaving it open. It will keep your credit active and show you have credit available that you are not utilizing and this does wonders for your score. Use the card periodically and pay it off to keep it open. If this does not appeal to you exercise caution when closing accounts. It’s always good practice to get it in writing that the account has a zero balance before closing. Errors can occur and charges posted to your account after closing and you will not be aware until your credit has been pulled the next time. It happens more often than it should and can really have a negative impact on your credit score.

If your credit is less than stellar it is up to you to show these poor repayment habits are a thing of the past and you are now paying on time. Lenders like to see at least 12 months of positive repayment and this will in most cases instill new established credit. If you are seeking new credit be aware of who is pulling your credit and exercise caution with regards to inquiries as this can negatively affect your score. Keeping inquiries to a minimum will save your credit score.

If you would like to see a copy of your current credit score see www.equifax.ca for a list of options to view your credit file. There are also other companies such as Borrowell and Credit Karma where you can check your score. It is always a good idea to monitor your credit history to confirm all reporting is accurate. It can take a considerable amount of time to correct any disparities and best to do it when it happens not when you need your credit history to qualify you for lending.